Net Worth Tracking

Home value, job title, car you are driving, account balances, vacations you take. These things are just a hint of how wealthy you are. The real financial truth comes down to just one number: net worth.

Your net worth is the most important number in your personal finance and tracking it gives you the most accurate picture of your complete financial health.

It is a snapshot of your financial life at one moment in time, a single number representing your financial health. As the saying goes, you never know how to get somewhere unless you know where you are right now. Knowing your net worth helps you make better decisions on how to accomplish your financial goals. Determining your net worth involves taking a good hard look at all aspects of your finances - the good and the bad.

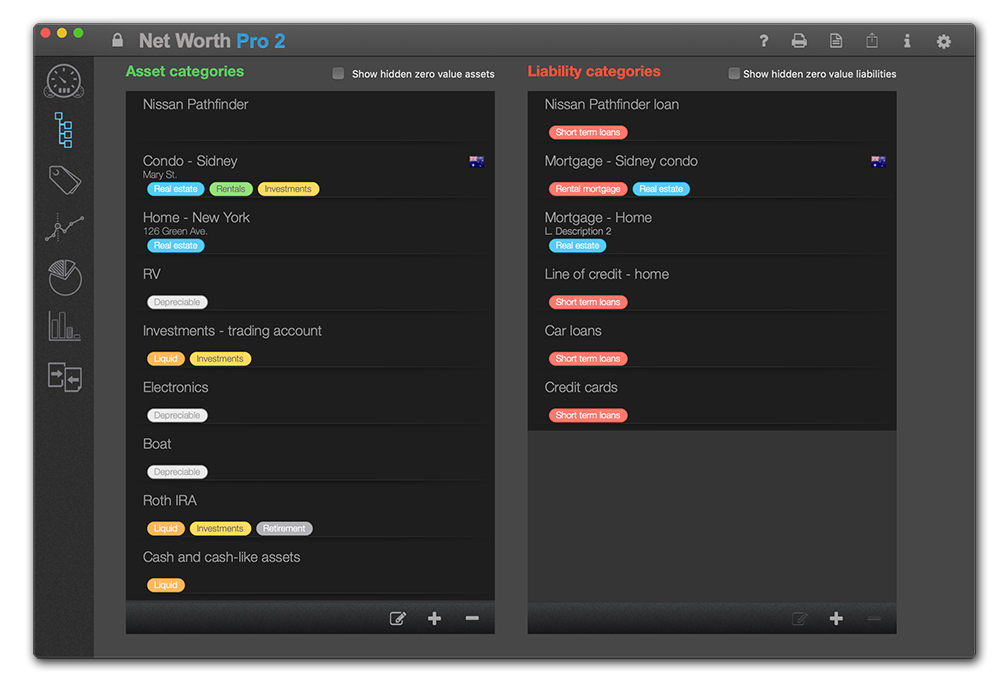

Net worth is a single amount representing how much money a person would have if he sold all his assets and paid off his debts. The following is a sample set of asset categories:

- Real estate - All your properties, both the principal residence and any rental or leisure properties)

- Cash - Any physical money you have

- Money someone owes to you - unless you don't expect the debts to be repaid

- Electronics/personal items - Any other valuables you would include in a home inventory

- Collectibles - jewelry, art or any other type of collectibles

- Money in bank accounts - All the money you have in your checking and savings accounts

- Retirement accounts - 401(k) funds, IRAs and any other retirement accounts (RRSP & TFSA accounts for Canadians)

- Investment accounts - Accounts holding stocks, bonds or similar investments

- Life insurance - Any cash value you have in the policy

- Cars and other vehicles - Your cars or any other vehicle (boats, bikes, ...)

Once you are done listing assets, make a separate list of liabilities and their amounts. For example, the most common ones are:

- Mortgage - The mortgage amounts left to be paid to your lenders

- Lines of credit - Home equity line of credit or any other line of credit you owe to lenders

- Car loans - Outstanding amount

- Student loans - Outstanding amounts on your student loans

- Credit card debts - Your current credit card balances

Your net worth equals to total value of all your assets minus total amount of all your liabilities:

YOUR NET WORTH = WHAT YOU HAVE – WHAT YOU OWE

So, why is knowing your net worth important?

- Net worth is the most accurate measure your wealth. There is no way to know exactly how wealthy you are without knowing what your net worth is.

- Tracking your financial progress. Since net worth is a specific number able to be tracked with precision, it enables you to measure your financial progress from one month or year to the next. It is like giving yourself a grade every month and helps keep your spending/savings for the month accountable. A growing net worth is the best sign you are moving forward. A decline in net worth means you have more work to do.

- Moving the financial focus beyond income alone. Even if your income is growing, if your net worth is flat or declining, your financial situation may not be improving at all.

- Avoids over-emphasis on asset value alone. For example, you may proclaim $250,000 in assets, while ignoring $200,000 in debt. It is not the size of either number that counts, but rather the difference between the two.

- Puts your debt level in proper perspective. A large debt number can seem scary, but if it is more than offset by a large asset position, it is not nearly as bad as it looks. For example, if you have $100,000 in debt — and $500,000 in assets — your debt level probably isn’t extreme.

- Net worth can be important when applying for a loan. Since net worth is the best measure of overall financial strength, lenders are often interested in knowing what it is in determining whether they will approve you for a loan.

- It motivates you to save. Monitoring your net worth could help you improve your finances by motivating you to save more money. Seeing your net worth grow motivates you to take right actions. You may no longer waste money on things that don’t add value or help you to reach your goals.

What is the right net worth for your age?

Your net worth depends on your individual circumstances, so it is difficult to set a certain figure.

One way to determine your goal net worth could be, as outlined in Thomas Stanley and William Danko's book The Millionaire Next Door, to multiply your age by your pre-tax annual income and divide the result by 10.

So, if you're 45 years old with an annual salary of $90,000, your net worth should be around $400,000.

Compare yourself against others.

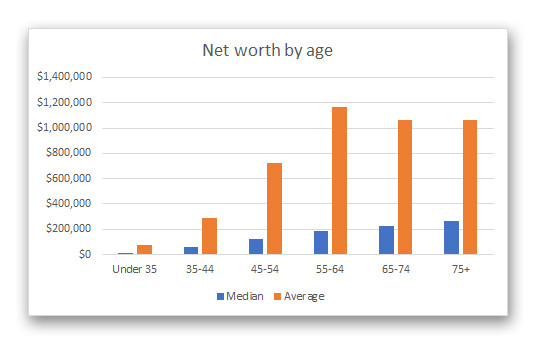

A household in the U.S. has an average net worth of $692,000, according to the most recent data from the Federal Reserve’s Survey of Consumer Finances.

Unfortunately, the average (“mean”) is skewed by the nation’s wealthy and may not be a good value to compare yourself to.

The median net worth of the average U.S. household is about $97,000. Median is the middle point where half the households have more, and half have less.

That means the median figure may be a better indicator of where you stand relative to others. The following are the median and average net worth by age according to the Federal Reserve Survey:

- Under 35: Median net worth: $11,100, Average net worth: $76,200

- 35-44: Median net worth $59,800, Average net worth: $288,700

- 45-54: Median net worth $124,200, Average net worth $727,500

- 55-64: Median net worth $187,300, Average net worth $1,167,400

- 65-74: Median net worth $224,100, Average net worth $1,066,000

- 75+: Median net worth: $264,800, Average net worth $1,067,000

How to increase your net worth

- Set goals - It’s easy to become passive about your future if you don’t have hard goals set in place. Come up with a number and a plan as to how you are going to grow your net worth towards the goal amount and stick to it.

- Cut expenses - Check if there are bills, subscriptions or habits that you can cut back on.

- Make investments - Let your money work for you while you sleep. If you let your money just sit in a savings account, you may end up with inflation eating it - just remember the price of a movie tickets of 15 years ago.

- Max out retirement/IRA (TFSA for Canadians) contributions - Take advantage of deferred or no taxation related to different retirement plans.

- Reduce debts - Don't let the banks collect interest from you. Pay of your debts and invest your money instead.

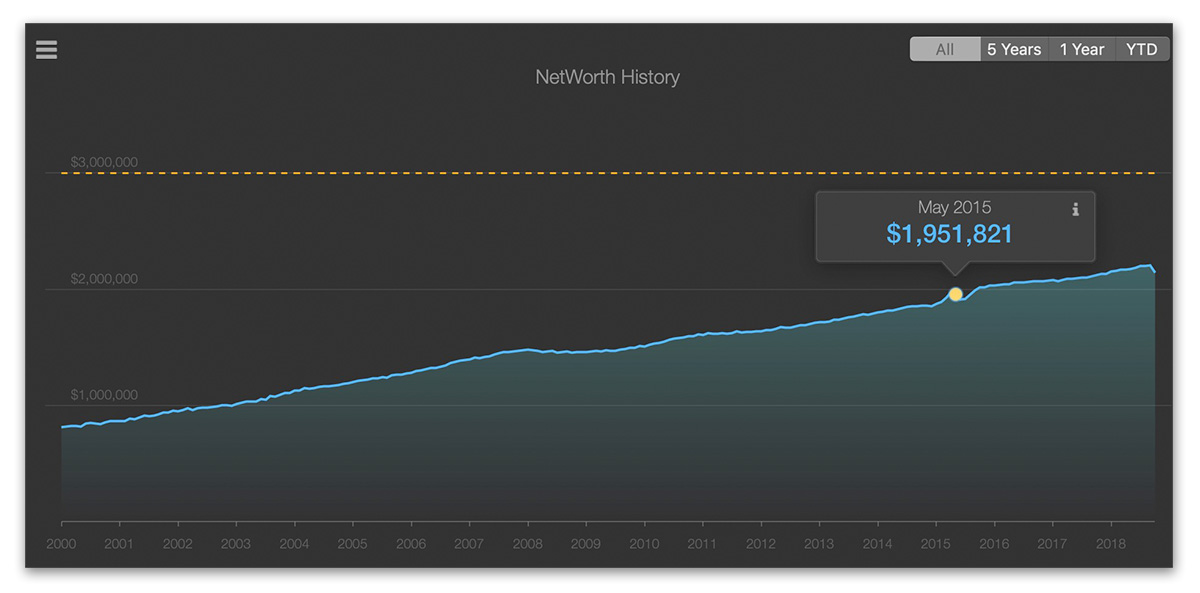

Once you come up with a plan to increase your net worth, check it regularly to make sure it is moving in the right direction.

How to track your net worth

The Blue Plum Software's Net Worth tracker family of applications let you track your net worth: